Explore thought-provoking content, specialist reports, and illuminating interviews from the Gain Theory team.

Audience insights | 28 December 2023

What role can generative AI play in marketing effectiveness?

Read more

Latest articles

Gain Theory people | 27 March 2024Introducing… Patricia Moro, Director

Read more

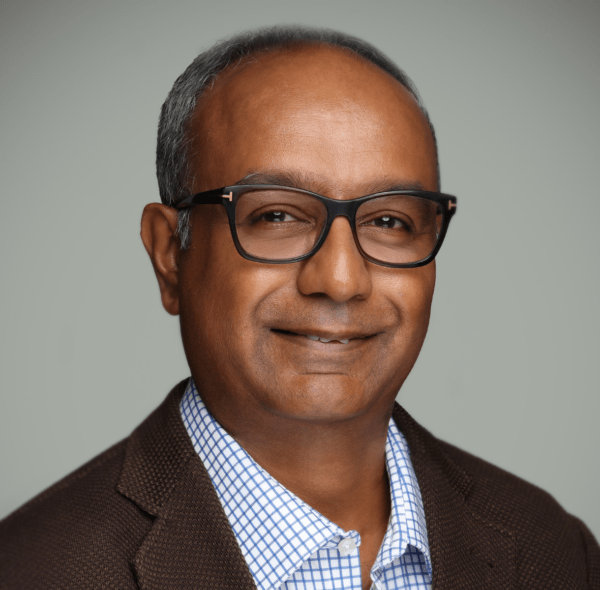

Gain Theory people | 29 February 2024

Introducing… Arvind Sethumadhavan, Client Growth Officer, APAC

Read more

Advertising and media | 12 February 2024

How granular geographic data delivers privacy-compliant insights and improves effectiveness

Read more

Filter by topic

Gain Theory people | 27 March 2024

Introducing… Patricia Moro, Director

Read more

Gain Theory people | 29 February 2024

Introducing… Arvind Sethumadhavan, Client Growth Officer, APAC

Read more

Advertising and media | 12 February 2024

How granular geographic data delivers privacy-compliant insights and improves effectiveness

Read more

Data and analytics | 26 January 2024

Unlock growth in 2024 with a new marketing effectiveness framework

Read more

Gain Theory people | 26 January 2024

Introducing… Alan Bloodworth, EMEA & APAC CEO

Read more

Audience insights | 28 December 2023

What role can generative AI play in marketing effectiveness?

Read more

Foresight | 13 December 2023

How mastering the power of foresight helps marketers to plan more effectively

Read more

Gain Theory people | 8 December 2023

Introducing… Aleksandr Feygis, Partner

Read more

Gain Theory people | 3 November 2023

Introducing… Manjiry Tamhane, Global CEO

Read more

Gain Theory people | 20 September 2023

Introducing… Yulia Shutko, Partner

Read more

Data and analytics | 11 August 2023

Driving growth with data: How marketers can help brands to overcome the barriers

Read more

Gain Theory people | 29 June 2023

Introducing… Claudia Sestini, Global CMO

Read more

Marketing in uncertainty | 11 May 2023

How marketing can strengthen its alliance with finance

Read more

Gain Theory people | 27 April 2023

Introducing… Sam Fellows, Managing Partner

Read more

Gain Theory people | 3 April 2023

Introducing… Zosia Jakobek, Senior Director

Read more

Data and analytics | 16 March 2023

6 things marketers can do to boost effectiveness by being more data-driven

Read more

Gain Theory people | 7 March 2023

Introducing… Maria Fadeeva, Partner

Read more

Audience insights | 3 February 2023

3 ways marketers can combat uncertainty and build confidence

Read more

Gain Theory people | 27 January 2023

Introducing… Chris Chumun, Partner

Read more

Advertising and media | 11 January 2023

How long does it take for CPG advertising to pay back?

Read more

Gain Theory people | 15 December 2022

Introducing… Lindsay Egan, Senior Partner

Read more

Advertising and media | 29 November 2022

How proving effectiveness is helping one retailer to defend media budgets

Read more

Gain Theory people | 24 November 2022

Introducing… Akhila Venkitachalam, Senior Partner

Read more

Advertising and media | 24 October 2022

Meta research: why ads with multiple objectives are more effective

Read more

Gain Theory people | 13 October 2022

Introducing… Russell Nuzzo, Managing Partner

Read more

Audience insights | 11 October 2022

How near-time audience insights improve marketing effectiveness

Read more

Foresight | 10 October 2022

Proactive steps marketers can take to mitigate recessionary impacts on their brand

Read more

Data and analytics | 17 February 2022

How marketers can use foresight in a volatile, uncertain, complex and ambiguous world

Read more

Advertising and media | 23 April 2020

Marketing effectiveness in an uncertain world

Read more

Gain Theory research | 13 February 2020

9 Golden Rules for Measurement

Read more

Gain Theory research | 23 October 2019

CTRL+ALT+CHANGE: The Growth Opportunity

Read more

Brand | 9 April 2019

Brand vs performance spend: Where should the pendulum swing?

Read more

Gain Theory research | 11 October 2018

How to achieve best-in-class marketing effectiveness

Read more

Advertising and media | 15 April 2018

Five key results from our long-term impact of media investment study

Read more

Advertising and media | 1 December 2017

The long-term impacts of advertising: a first-of-its-kind study

Read more

Advertising and media | 29 March 2017

Long-term effects of advertising

Read more